British American Tobacco (BAT) reported higher first-half sales on Thursday, helped by higher demand for e-cigarettes and tobacco heating products, and said revenue growth would accelerate in the second half of the year.

The Lucky Strike and Dunhill cigarette maker, which is the world's No. 2 tobacco company, said its first-half revenue rose 4.6% to £12.17 billion (€13.4 billion) beating an average forecast by analysts of £12.09 billion.

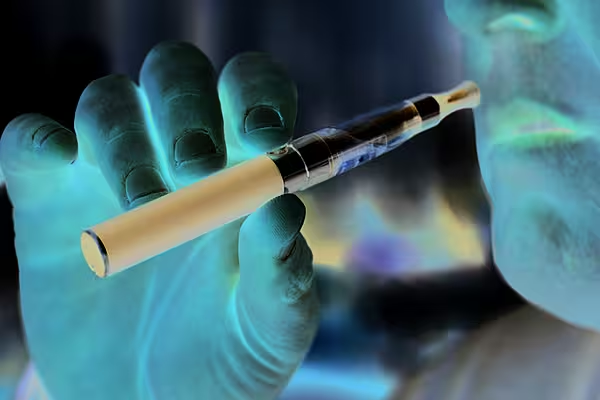

The company said growth came mainly from its new categories that include modern oral products, e-cigarettes and tobacco heating products, with revenue from that category rising 27% to £531 million (€582 million) in the first half.

E-Cigarette Demand

Europe and Canada led e-cigarette demand, while Japan led the demand for its tobacco heating product glo and Russia for oral products, said Simon Cleverly, Group Head of Corporate Affairs.

BAT also said that in May the BAT UK Pension Fund entered into a buy-in transaction with Pension Insurance Corporation plc, to transfer £3.4 billion (€3.7 billion) of assets.

The deal secures benefits for 10,600 members, including 8,300 pensioners and 2,300 non-pensioners.

The Pension Insurance Corp separately said the deal was the third-largest transaction in the United Kingdom and was the largest-ever including both pensioner and deferred members.

BAT's adjusted earnings per share came in at 149.3 pence, beating analysts' estimates of 146.15 pence, according to Refinitiv's I/B/E/S.

BAT also said it was on track to be "around the middle" of its guidance range of 30-50% of annual revenue growth from new categories, on a constant currency basis.

News by Reuters, edited by Checkout. Click subscribe to sign up for the Checkout print edition.