This year, Checkout commemorates its 40th anniversary, and with this in mind, every week, Retail Intelligence is going to 'reel in the years' and publish a story from our extensive archives. This article first appeared in Checkout in January 2000.

When Aldi arrived in Ireland three months ago, it got the sort of publicity that it wouldn’t dream of paying for – the cost-cutting German discounters confined its ‘paid for’ advertising to local radio and outdoor. But with the national media determined to make a story out of a 9,000 sq. foot outlet in Parnell Street, Dublin, everyone in the capital soon knew everything there was to know about Aldi.

Now that the dust has settled slightly, Checkout reporters Máirín O’Malley and Alan Roche have put this small discount store to the test. Alan questioned shoppers about the Aldi shopping experience, while Máirín asked three young people to blind test six Aldi own label products against two leading brands in their category.

The arrival of Tesco in 1997 signalled that the Irish retail sector had become attractive to foreign investors. Almost three years down the road, and despite some grievous problems, the UK chain has now established a strong presence in the Republic, and Irish multiples and symbol groups face competition from yet another foreign grocery chain.

Aldi (an abbreviation of Albrecht Discount) has a presence in 11 countries worldwide – the stores in on Parnell Street, Dublin and Ballincollig, Cork are just two of the 5,000 outlets now operated by the German retailer. In the UK since 1990, Aldi has a network for 250 stores there and intends to continue opening 25 to 30 new stores annually in the UK market. Aldi’s ability to expand the number of its retail outlets at high speed and its strong value image could spell trouble for Irish retailers.

Like Wal-Mart, the American retail giant which recently purchased ASDA in the UK and which is supposedly in takeover talks with Dunnes Stores, Aldi’s philosophy is ‘Stock it High, Sell it Cheap’.

The typical Aldi store is a relatively small outlet, with low prices, and an emphasis on maximising efficiency. On entering the Irish market, the discounter boasted it that it would cut the average Irish grocery bill by a third. However, Aldi has landed in an Irish retail sector that has begun to turn its back on price competition. Value added services such as home delivery have been combined with expanding ranges and pleasant shopping environments to produce a sector that values service over price.

Aldi outlets sell a limited range of products (550-600), a mixture of food, wine and consumer durables. It also maintains a constant flow of one off ‘special buys’, that includes electrical goods and textiles.

Aldi relies on bargain hunters and is confident that there are plenty of people in Ireland who fall into that category. It plans to invest £10 to £20 million in the Irish market, opening eight to ten new stores countrywide by the end of this year, with a central distribution centre also in the pipeline. There will be 30 to 40 Aldi stores in the Republic before the end of the decade, and 100 across the 32 counties.

The Dublin store carries a restricted range of products with no recognisable brand names. Aldi own label products appear under different names, Grandessa, Alcafe, Belmont, Ameristar, Sprinters and are specially packed for the company with an address at Atherstone, Warwickshire, England. Goods are piled into stainless steel cage-type baskets, choice is limited in each category, as is choice in sizes. There is a small fresh produce section, also a wine section, but no meat counter. Goods are not scanned and product names do not appear on till receipts.

In developing its own label food products, Aldi says it uses both branded products and other supermarket own brands as the benchmark for its quality and taste standards. The company offers unequivocal money back guarantee if a customer is not completely satisfied.

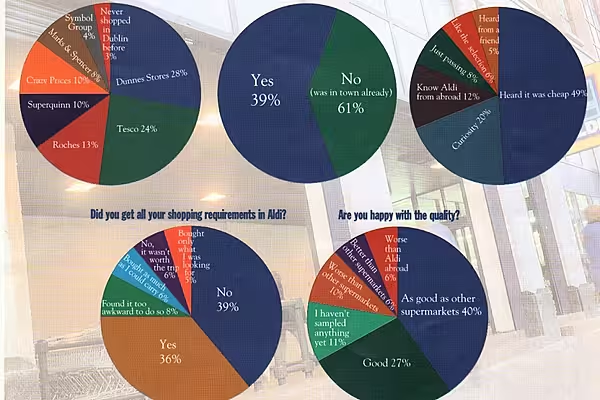

Alan Roche asks 100 Aldi customers what they think of the German discounter’s store in Parnell Street, Dublin. Overall, the shoppers questioned (among whom were a sizeable number of non-nationals) were impressed with Aldi. When asked if they would travel to shop in Aldi, 7% of respondents said they definitely would, 4% said they definitely wouldn’t, while the majority weren’t sure.

Problems mentioned included the lack of parking facilities, with shoppers having to wait on Parnell Street while a friend/partner/spouse brought the car to the front of the shop to load up. Adding to the shopping discomfort is the fact that there is little protection from the elements at the Aldi entrance – but our survey was conducted in January.

Aldi charges 3p for each plastic bag, which some shoppers regard as a problem. However, a German national (obviously loyal to his fellow countrymen) who overheard these complaints pointed out that these Irish shoppers had little to complain about, having saved about a third on their shopping bills. Aldi says that it charges for bags to save money, but also to encourage customers to re-use bags and be environmentally friendly.

Some older people complained that there were no baskets, only trolleys – Aldi says this is to limit the number of people shopping in the store at any one time. “The outlet isn’t large and cannot manage large volume, just consistent trade,” says its PR spokesperson.

In response to suggestions that the store is of inferior quality, with an inferior range of goods to the outlets on the continent and in the UK, the spokesperson says that although Aldi’s “philosophy applies equally in every outlet in the worldwide, each one is suited to the country in which it is situated and carries a slightly different range of goods.”

© 2015 - Checkout Magazine