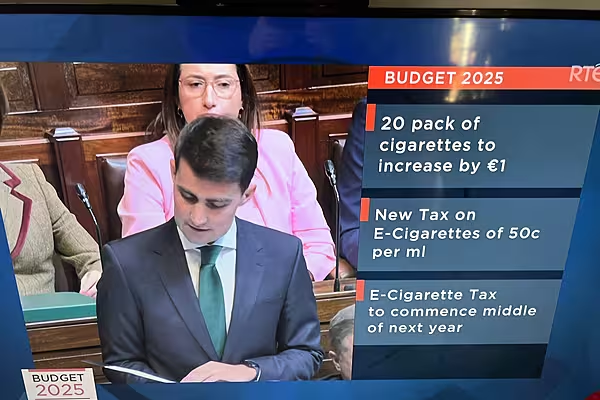

Yesterday’s Budget revealed plans to increase the minimum wage and tobacco product prices, and it included tax changes.

Retail bodies have reacted to the news, with Retail Excellence Ireland calling the Budget a ‘wasted opportunity’ for the sector, as calls for reducing the VAT rate to 9% were ignored.

The Convenience Stores’ and Newsagents’ Association (CSNA), Retailers Against Smuggling (RAS), Dublin Town and Sandyford Business District are among those responding to the news.

‘Two VAT Rates’

The chief executive of Dublin Town, Richard Guiney, noted that businesses were struggling across the country, and a reduction in VAT rates would be an “obvious practical step” to keeping the doors open.

Guiney said, “Two VAT rates – of 20% and 10% – should apply. Dublin Town supports increases in carbon taxes to offset such VAT reductions, and tax warehousing needs to be extended. Businesses are closing due to the cash flow implications of meeting these debts. We advocate a commission be established to address this.

“Rates are an obsolete and redundant form of revenue-raising. We advocate the replacement of rates with online sales and land taxes.

“Dublin Town supports the concept of living over the shop and the conversion of excess office space into residential use.

“This will require state finance. The government must move on this.

“To preserve economic progress, we urgently need to address our infrastructural deficits in transport, water, housing, and energy generation.

“While Dublin Town welcomes moves to address this, it warns that it must be done in a strategic manner.”

‘Securing Ireland’s Economic Future’

Sandyford Business District’s chief executive, Ger Corbett, however, welcomed the Budget’s measures.

Corbett said, “Many of the budgetary measures brought in by the government today will help businesses of all sizes to address the rising costs of doing business while securing Ireland’s economic future.

“Sandyford Business District’s Budget proposal had sought tax cuts and one-off measures for businesses hit by energy costs and inflation, and we are delighted that these measures have been included in Budget 2025.

“The strategic investment of the Apple windfall in capital infrastructure projects, including an immediate €3 billion investment, will be instrumental in driving critical infrastructure delivery across the country, while also ensuring that we are prepared for disruptions that are bound to take place in the years to come.”

‘We Will Seek Clarification’

Vincent Jennings of the CSNA weighed up the positives and negatives for small retailers in his statement, noting minimum wage, an increased Garda presence, and tobacco’s excise.

Jennings said, “The increase to the minimum wage of 80 cent per hour will far outweigh the flat €4,000 grant that is provided for in the Budget.

“We welcome the announcement that 1,000 additional Gardai are to be recruited.

“However, we are disappointed that the minister’s speech did not contain any indication that accelerated capital allowances for reverse vending machines would be provided for.

“We are pleased that there has been a significant increase in the non-cash benefit that employers can give to staff members.

“While the government is free to increase the tobacco excise duty by €1 per pack of 20, [the] CSNA needs to set out its concern that this move will further exacerbate the growth of purchases of duty-free and duty-paid tobacco from other jurisdictions.

“Last year, 34% of all tobacco consumed in Ireland came from sources that did not contribute to the Exchequer. This increase will ensure an even higher proportion will ensue.

“We will seek clarification from Revenue on the methodology they intend to use for the new excise on vaping, particularly around the transition period.”

‘A Further Blow’

RAS was similarly disappointed at the increase in excise for tobacco products.

The organisation released a statement, noting that it was ‘disappointed’ with the increase in excise tax on tobacco products, calling ‘illegal cigarette sellers’ the ‘big winners’ of the Budget.

The statement read, ‘RAS believes this excessive excise increase represents a big win for illegal tobacco sellers and represents a further blow to legitimate Irish retailers.

‘Government is continuing to ignore the increasing levels of illicit tobacco products in Ireland, with Revenue finding that the last two consecutive years had the highest level of illicit cigarettes on record, which is clearly being fuelled by excessive excise hikes.

‘In 2023, 19 per cent of cigarette packs held by smokers were illegal, and an additional 15 per cent were legal but non-Irish duty paid (duty-free purchased).

‘This is the highest level of illegality and excise evasion recorded in this series of Revenue surveys since commenced in 2009.

‘According to RAS, excise increases are driving the trends towards illicit market activity when it comes to cigarettes.

‘With prices on the black market reportedly as low €5-6, the latest excise increase threatens the business of local retailers, which has already drastically shrunk in recent years.

‘With criminal gangs increasingly being linked to illicit cigarette sales, this excise increase rewards criminal gangs ahead of the interests of legitimate retailers.

‘By increasing the excise duty on tobacco by one euro, once again, the government has effectively thrown fuel on the fire, further driving consumers towards the illegal market and threatens the income of legitimate retailers.’