Who will be the winners and losers of Christmas 2024? Data and insights experts Talysis Ltd look at a few key categories that could provide us with some pointers

Last Christmas was a record-breaker for grocery, with an all-time high of €1.4 billion worth of sales in December 2023.

While shoppers made an extra 3.4 million trips year on year, the value increase was fundamentally driven by inflation.

With 2024 seeing a strong deceleration of grocery price inflation – currently 2.76% [Kantar] for the 12 weeks to 29 September – how will the big three respond to the latest challenges?

Retailer Trends

In our last feature in the August issue of Checkout, it was clear that the major supermarkets were ramping up their promotional activity, to drive sales and grow market share.

The increased level of promotions within Dunnes and Tesco versus SuperValu is seemingly working with shoppers; Dunnes (24%) and Tesco (23.4%) continue to battle it out for the number one spot, while SuperValu’s market share, at 19.6%, is slipping [Kantar data for 12 weeks to 29 September 2024].

Even the discounters have lost ground in the last couple of months, with Aldi and Lidl combined accounting for 25.4% of the market in the September figures versus 25.9% in July.

Nevertheless, early indications are that Christmas mechanics and activity levels could be broadly similar to recent years.

Sharing Is Caring

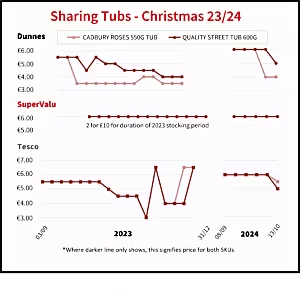

The battle of the sharing tubs commences!

Last year, Tesco were the first major supermarket to launch and that looks to have happened again this year, with the retailer stocking these lines from early September.

There are two main observations year on year: the first is a higher opening launch price of €6 across all retailers, compared to €5.50 in Tesco and Dunnes in 2023, and the second is that SuperValu have launched with just the single price point.

Last year, SuperValu ran a multi-buy deal for the entire stocking period, offering 2 for €10, versus single tubs at €6.

As Talysis’s Price Cube solution flags changes in price and promotions, both retailers and brands can keep track of the competition and react accordingly.

The historical data also acts as a useful predictor of future activity, so it is reasonable to assume that there will be similar patterns of price promotions this year, at least within Dunnes and Tesco.

For instance, Dunnes were again the first to blink with their price reductions, although they waited an extra week this year to drop the price of Roses to €4.00, followed by a reduction on Quality Street to €5.00 a week later.

Tesco were still holding firm, just like 2023, where they held the same price for seven weeks, before also dropping to €4.50.

However, just as we are going to print on this feature, the data for the week ending 13 October saw Tesco reduce to €5.50 and €5.00 on Roses and Quality Street respectively.

We would expect a raft of price reductions from here on in with those two retailers and even price increases above the €6 mark for Tesco when it embarks on a high-low pricing strategy to capture sales in the final few weeks.

The big intrigue is around SuperValu’s strategy. Are they holding their multi-buy ‘2 for €10’ offer up their sleeve for a later date or will they simply engage in single price promotions this year?

Getting In The Spirit

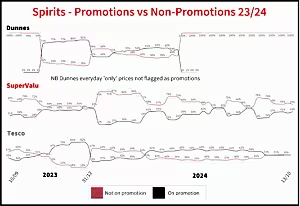

Unsurprisingly, there is a lot of promotional activity on spirits over the festive period.

But does that start off strong and then fade towards the big day, or does it continue throughout the festive season?

The Talysis PriceCube shows that the number of promotions on spirits continues to rise right up until Christmas.

From a shopper perspective, availability permitting, that is ideal for those last-minute gifts!

Tesco are significantly stronger on spirit promotions than their rivals.

From late October/early November, it is around a 50/50 split between promoted and non-promoted spirits.

From that point onwards, the number of offer lines increases every week until Christmas, by which point around 80% of spirit SKUs are on promotion in Tesco.

The escalation of promotions occurs around the same time within Dunnes (late October), albeit from a much lower starting point of activity.

While SuperValu also begins with a much smaller number of lines on promotion, it does eventually hit the 50/50 ratio just in time for Christmas, a split we see in Tesco as far back as late October.

It is rare for SuperValu to have more lines on promotion than off.

How are things shaping up this year?

In recent months, Tesco has had more spirit lines on promotion than off, although in the past few weeks this is back to a 50/50 split.

Like last year, they appear ready to make a big charge towards Christmas.

Similarly, it looks as though Dunnes’ promotions will soon take off and overtake the non-promoted lines.

And, based on SuperValu’s lower promotional threshold overall, we predict at most a 50/50 split once more by the time the final festive sales take place.

And Wine Not?

It’s a similar story in wine, although Tesco have ramped up their promotions year on year at this stage.

There are already more promoted than non-promoted lines, even before the anticipated escalation of activity at the end of October.

Like spirits, it looks likely that Tesco will have 80% of wine on some sort of offer by Christmas week.

Winner Winner, Turkey Dinner!

And finally, a quick look at fresh turkey within Tesco, where we see the exact same trend across all sizes of birds.

Generally introduced at the end of October, at a standard price, it then drops for five weeks until early December.

Further price reductions take place over the next fortnight, before the range reverts to full price in the week prior to Christmas.

Although not currently a focus area for Talysis, we do have the ability to track any SKUs, so it will be interesting to see how this year pans out!

In summary, 2024 looks set to culminate in a fierce battle for market share, particularly between the two current leaders, Dunnes and Tesco.

While promotional activity isn’t the sole factor driving Christmas performance, our insights do point towards similar strategies – and therefore outcomes – to 2023. It is now down to shoppers to decide who wins this year’s festive campaign.

Read More: Meet Mr Reliable

About Talysis

Talysis specialises in the analysis, interpretation and application of retail sales data within FMCG categories. Currently working with some of the biggest names in retail and manufacturing across Ireland and the UK, Talysis helps brand owners, retailers and wholesalers to capitalise on their data and maximise their sales. Its bespoke application of data is what sets Talysis apart, providing clients with actionable insights to make strategic decisions and interventions. For further information, visit talysis.co.uk

Read More: So, This Is Christmas